Time to Revive the Forex Education Stop hunting process

As all of you know that Forex is a place where there are enough orders to execute the facilitation & in case if there are not enough orders, price will remain in consolidation mode for days, weeks and even months. Forex price Action moves with orders in the opposite side & when enough orders are collected, then price does moves rapidly against the large orders of Retail Traders or investors. This can is done highly by investment funds, hedge fund managers, banks & by and large market maker brokers.

Just imagine if you are broker of a large scale & you have orders execution report of your traders & when you know 70 percent of traders are long, then you create an environment to hunt stop losses and move the price in the favor of 30 percent of traders, who keep involved in trading and make sure that they have enough profit to execute their next trade.

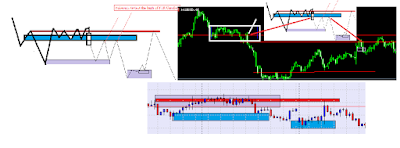

Forex Order Flow & stop hunting process Explained in Chart below

I took couple of trades in last month with zero to minimal draw down & that can happen to you at large if you keep yourself involved in most of the price action techniques I have explained since years. In first chart, I took an Aussie trade, Candle that left the zone had enough momentum and if you take a look left, then you see a drop base drop with momentum and false retests which tells you that there are traders who are long at false demand and as price hold these areas above demand and there was good reason for us to believe that most of the traders are long there.

IF there are not enough order flow,price will consolidate & create new zone here and there to encourage long trades & this is what we always need to be aware of while executing a trade that we need to remain alert where the stops are placed and that is how we can have edge & always take trades that are offering atleast 1:7 or more risk reward because bit of looses here and there will make up for a trade when it is time to trigger a trade.

Euro dollar Expected price Action in coming week

Euro is all set for bullish rally to test the long term resistance around 1.12570ish area, but are we expecting that rally to stall at this time of risk aversion. I am eyeing the fake test of 1.1270 area with euro fail to reach the 1.1291 area & bears again attack this area for one last time to test the demand level around the recent lows.

No matter what happens with price, I always look at the chart and then decide.

Forex price action are not based on assumptions and rumours, although there are chance of rate cuts in U.S are on the cards with no inflation in U.S and adaptive policy measures taken by Fed, but that can put impact on retail traders to remain bullish on Euro with the break of 1.1300 line & that is why this area is very crucial.

Take a short at 1.1290 line & put the stops around 1.1327 level & see if we can test 1.1100 again, this trade offers 1:7 risk reward with reversing the trade after that price line is breached.

Possible price Action zone in Euro is sighted in the chart below

It is a question of concern for me to where to look for opportunity in the euro but If we have clear breakout of 1270 area, then there is doubt in my mind to whether it would be good to short Euro around the levels I mentioned below.

But price Action techniques told me to stick to the plan and watch for Price Action in the supply zone which was created on weekly with a shooting star mentioned by arrows

I would rather wait for the price action to unfold on h4 timeframe to look out for best area to short again . I already had good profits shorting euro around 1240 levels , So I can afford to risk few extra pips but I would advice to look for update first on the blog before taking any trade. Touch Trade is possible but first approach to Price Action zone is awaited & then we possibly will caught reaction.